Purpose

Mission

Arcobaleno Capital LLC is looking to acquire and actively manage a single business. our core belief is that the success of a business begins with a focus on its people and a set of shared values.

We are committed to maintaining the company’s legacy while driving sustainable growth to create long-term value for all stakeholders, including employees, customers, shareholders and the broader community.

Leadership Transition

Arcobaleno Capital LLC provides an attractive solution for business owners looking to transition leadership. We can structure a tailored transaction that best meets your personal and professional goals. Common situations include:

At or near retirement

Planning to pursue other entrepreneurial opportunities

Looking to reduce day-to-day involvement

Seeking a liquidity event or exit

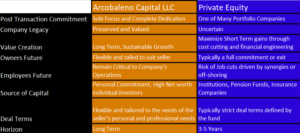

The Arcobaleno Capital difference

F.A.Q.

Relevant Questions

Yes. There is a process. A high level process would contain the following items

- Discuss with the business owner (s) their wants,

- Preliminary review consists of an indicator of interest (IOI) and an non disclosure agreement (NDA) in exchange for relevant business information

- Site Visit, Letter of Intent (LOI)

- Due Diligence

- Closing

There are more obvious reasons and less obvious ones. The more obvious ones are

- There is a compelling reason to sell such as a life event. Such as divorce, death or dissolution of a partnership.

- Loss of passion in the business

- Your business is profitable. Selling when your business is profitable maximizes the value you will receive.

- Retirement and desire for a comfortable way of life.

A partial list of items might include the following

- Determine what you will want to do. Do you want to have involvement in the business going forward?

- Develop outside interests or develop a plan to pursue interests.

- Get the business in order – do a spring cleaning, get financial records in place, determine what you are selling and get a realistic idea of what your business may be worth

Most sellers agree that “Getting full value for their business to fund retirement or other business interests” was their top goal in the transition of the business, yet most haven’t had a formal valuation conducted in the last three years, and the majority have never had their financial statements audited. You should make efforts to be knowledgeable and aware in advance.

This is a personal choice. There is no requirement that you do or you don’t.

Brokers are extremely helpful in the process. They can educate and assist in the transaction.

In return you as the seller will pay a fee contingent upon the successful sale.